Our FGR Funds

Our FGR funds cover Index, ESG and Factor exposures, explore these using the tabs below.

The Benefits of Index Investing

As our FGR funds are passively managed, they offer investors a low cost, transparent and efficient way to capture the returns of a market with the additional benefit of tax efficiency. Index funds can be seen as useful building blocks for investors seeking to construct diversified portfolios as they capture the market return across a range of asset classes.

Choose an Index Fund:

Northern Trust Developed Real Estate Index UCITS FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the FTSE EPRA/NAREIT Northern Trust Developed Index (the Index) with net dividends reinvested. The Fund invests in equities that is, shares and other similar kinds of assets, of real estate investment trusts (REITs) and Real Estate Holding & Development companies which make up the Index.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients looking for a passively managed investment in the relevant market(s) who plan to invest over the long term.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

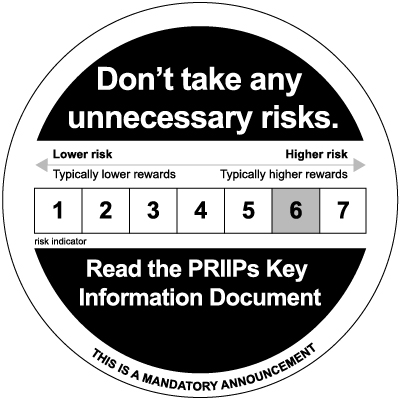

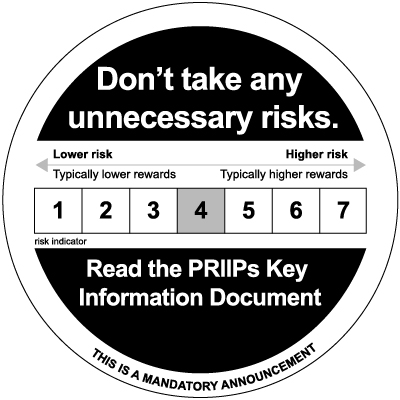

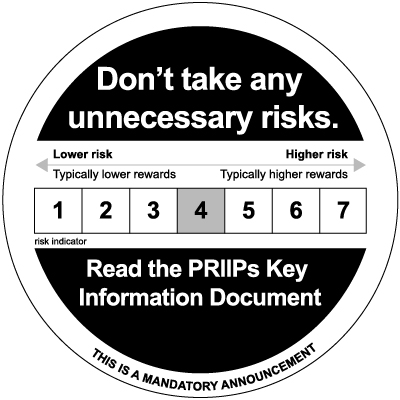

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for Northern Trust Developed Real Estate Index UCITS FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

Integrating ESG

Environmental, social and governance (ESG) criteria are growing in importance and it is becoming increasingly difficult for investors to ignore the impact of these issues on their portfolios. In our range of FGR funds we leverage our extensive experience in this area to integrate ESG factors with both traditional and innovative investment methods. Our aim is to preserve and create value for investors whilst reflecting their principles.

Choose an ESG Fund:

NT Real Estate Climate Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the Solactive Developed Real Estate ESG Climate Index NTR (the "Index") with net dividends reinvested. The Index (i) excludes companies not considered to meet socially responsible principles; (ii) excludes companies with a GRESB score of 1 or 0 if they also have a Northern Trust ESG Vector Scores which is in the bottom decile and; (iii) seeks reduce exposure to companies with high carbon intensity and ensure an uplift of the carbon risk rating relative to the Parent Index. The Index additionally excludes companies not considered to meet socially responsible principles identified by applying criteria that refer to the UN Global Compact ten principles, as well as other ESG criteria selected by the Investment Manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients who plan to invest over the long term; for example 5 years or more; and are looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions.

- The fund may not be appropriate for investors who plan to withdraw their money within 5 years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT Real Estate Climate Index FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

- KID - Unit Class A EUR

- KID - Unit Class B EUR

- KID - Unit Class C EUR

- KID - Unit Class D EUR

- KID - Unit Class E EUR

- KID - Unit Class E EUR Hedged

- KID - Unit Class F EUR

- KID - Unit Class H GBP

- KID - Unit Class I EUR

- KID - Unit Class J EUR

- KID - Unit Class S EUR

- KID - UNIT CLASS S EUR HEDGED

- KID - Unit Class A EUR (DE)

- KID - Unit Class B EUR (DE)

- KID - Unit Class C EUR (DE)

- KID - Unit Class D EUR (DE)

- KID - Unit Class E EUR (DE)

- KID - Unit Class E EUR Hedged (DE)

- KID - Unit Class F EUR (DE)

- KID - Unit Class H GBP (DE)

- KID - Unit Class I EUR (DE)

- KIID - Unit Class J EUR (DE)

- KID - Unit Class S EUR (DE)

- KID - UNIT CLASS S EUR HEDGED (DE)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

- KIID - Unit Class A EUR

- KIID - Unit Class B EUR

- KIID - Unit Class C EUR

- KIID - Unit Class D EUR

- KIID - Unit Class E EUR

- KIID - Unit Class E EUR Hedged

- KIID - Unit Class F EUR

- KIID - Unit Class H GBP

- KIID - Unit Class I EUR

- KIID - Unit Class J EUR

- KIID - Unit Class S EUR

- KIID - UNIT CLASS S EUR HEDGED

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NT Emerging Markets Screened Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Emerging Markets NTC Screened Index (the “Index”) with net dividends reinvested. The Index corresponds with the MSCI Emerging Markets Index with the exclusion of companies not considered to meet socially responsible principles, identified by applying criteria that refers to the UN Global Compact ten principles, as well as other Environmental, Social and Governance (ESG) criteria selected by the investment manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients who plan to invest over the long term; for example 5 years or more; and are looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT Emerging Markets Screened Equity Index FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

- KID - Unit Class A EUR

- KID - Unit Class B EUR

- KID - Unit Class E EUR

- KID - Unit Class F EUR

- KID - UNIT CLASS G EUR

- KID - Unit Class H EUR

- KID - Unit Class I EUR

- KID - Unit Class K EUR

- KID - Unit Class L EUR

- KID - Unit Class M EUR

- KID - Unit Class A EUR (DE)

- KID - Unit Class B EUR (DE)

- KID - Unit Class E EUR (DE)

- KID - Unit Class F EUR (DE)

- KID - UNIT CLASS G EUR (DE)

- KID - Unit Class H EUR (DE)

- KID - Unit Class I EUR (DE)

- KID - Unit Class K EUR (DE)

- KID - Unit Class L EUR (DE)

- KID - Unit Class M EUR (DE)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NT Europe Screened Equity Index FGR Feeder Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Europe NTC Screened Index (the Index) with net dividends reinvested through the master-feeder structure. The Index corresponds with the MSCI Europe Index with the exclusion of companies not considered to meet socially responsible principles identified by applying criteria that refer to the UN Global Compact ten principles, as well as other Environmental, Social and Governance (ESG) criteria selected by the investment manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients who plan to invest over the long term; for example 5 years or more; and are looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT Europe Screened Equity Index FGR Feeder Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Investor Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NT Europe Screened Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Europe NTC Screened Index (the Index) with net dividends reinvested. The Index corresponds with the MSCI Europe Index with the exclusion of companies not considered to meet socially responsible principles identified by applying criteria that refer to the UN Global Compact ten principles, as well as other Environmental, Social and Governance (ESG) criteria selected by the investment manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions who plan to invest over the long term.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT Europe Screened Equity Index FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NT North America Screened Equity Index FGR Feeder Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI North America NTC Screened Index (the Index) with net dividends reinvested through the master-feeder structure. The Index corresponds with the MSCI North America Index with the exclusion of companies not considered to meet socially responsible principles identified by applying criteria that refer to the UN Global Compact ten principles, as well as other Environmental, Social and Governance (ESG) criteria selected by the investment manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients who plan to invest over the long term; for example 5 years or more; and are looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT North America Screened Equity Index FGR Feeder Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NT North America Screened Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI North America NTC Screened Index (the Index) with net dividends reinvested. The Index corresponds with the MSCI North America Index with the exclusion of companies not considered to meet socially responsible principles identified by applying criteria that refer to the UN Global Compact ten principles, as well as other Environmental, Social and Governance (ESG) criteria selected by the investment manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions who plan to invest over the long term.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT North America Screened Equity Index FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

- KID - Unit Class A EUR

- KID - Unit Class A USD

- KID - Unit Class C EUR

- KID - Unit Class E EUR

- KID - Unit Class G EUR

- KID - Unit Class A EUR (DE)

- KID - Unit Class A USD (DE)

- KID - Unit Class C EUR (DE)

- KID - Unit Class E EUR (DE)

- KID - Unit Class G EUR (DE)

- KID - Unit Class A EUR (SE)

- KID - Unit Class A USD (SE)

- KID - Unit Class C EUR (SE)

- KID - Unit Class E EUR (SE)

- KID - Unit Class G EUR (SE)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NTCM North America Low Carbon Plus Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return of the MSCI North America Selection Low Carbon Plus G Series Index (the “Index”) with net dividends reinvested. The Index is a custom index which corresponds with the MSCI North America Index, a free float-adjusted market capitalisation weighted index that is designed to measure the equity market performance in the North America region.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented using a defined set of exclusions, tilts, ESG ratings and a low carbon methodology.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NTCM North America Low Carbon Plus Equity Index FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

NTCM Emerging Markets Plus Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Emerging Markets Selection Plus Index (the "Index") with net dividends reinvested. Any change of investment objective of the Fund shall only be made with the prior approval of the Unitholders.

Investor Profile

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

NT Emerging Markets PAB Plus Equity Select Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Emerging Markets PAB Plus Equity Select Index (the “Index”) with net dividends reinvested. The Index is designed to meet the standards of the EU Paris Aligned Benchmark ("PAB"), aiming to reduce the weighted average greenhouse gas intensity relative to the MSCI Emerging Markets Index (the “Parent Index”) by 50% and reduce the weighted average greenhouse gas ("GHG") intensity by 7% on an annualized basis.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT Emerging Markets PAB Plus Equity Select Index FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

NTCM Emerging Markets Low Carbon Plus Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Emerging Markets Selection Low Carbon Plus G Series Index (the "Index") with net dividends reinvested. Any change of investment objective of the Fund shall only be made with the prior approval of the Unitholders.

Investor Profile

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NTCM Europe Low Carbon Plus Equity Index FGR Feeder Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Europe Selection Low Carbon Plus G Series Index (the "Index") with net dividends reinvested through the master-feeder structure. The Index is a custom index which corresponds with the MSCI Europe Index which captures large and mid-cap representation across 15 developed markets in Europe, based on MSCI definitions. The Index then applies a series of exclusions based on MSCI ESG data.

Investor Profile

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs. https://www.fgrinvesting.com/

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

NTCM World Low Carbon Plus Equity Index FGR Feeder Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI World Selection Low Carbon Plus G Series Index (the "Index") with net dividends reinvested through the master feeder structure. The Index is a custom index which corresponds with the MSCI World Index which captures large and mid-cap representation across developed markets, based on MSCI definitions. The Index then applies a series of exclusions based on MSCI ESG data.

Investor Profile

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

NT Pacific Screened Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Pacific NTC Screened Index (the “Index”) with net dividends reinvested.

The Index corresponds with the MSCI Pacific Index with the exclusion of companies not considered to meet socially responsible principles identified by applying criteria that refer to the UN Global Compact ten principles, as well as other Environmental, Social and Governance (ESG) criteria selected by the investment manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions who plan to invest over the long term.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT Pacific Screened Equity Index FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

- KID - Unit Class A EUR

- KID - Unit Class B EUR

- KID - Unit Class C EUR

- KID - Unit Class D EUR

- KID - Unit Class E EUR

- KID - Unit Class F EUR

- KID - Unit Class G EUR

- KID - Unit Class A EUR (DE)

- KID - Unit Class B EUR (DE)

- KID - Unit Class C EUR (DE)

- KID - Unit Class D EUR (DE)

- KID - Unit Class E EUR (DE)

- KID - Unit Class F EUR (DE)

- KID - Unit Class G EUR (DE)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NTCM Pacific Low Carbon Plus Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Pacific Selection Low Carbon Plus G Series Index (the “Index”) with net dividends reinvested. The Index is a custom index which corresponds with the MSCI Pacific Index, a free float-adjusted market capitalisation weighted index that is designed to measure the equity market performance in the Pacific region, consisting of developed market country indices.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented using a defined set of exclusions, tilts, ESG ratings and a low carbon methodology.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NTCM Pacific Low Carbon Plus Equity Index FGR Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

NT World Screened Equity Index FGR Feeder Fund

The investment objective of the Fund is to closely match the risk and return of the MSCI World NTC Screened Index (the Index) with net dividends reinvested through the master-feeder structure. The Index corresponds with the MSCI World Index with the exclusion of companies not considered to meet socially responsible principles identified by applying criteria that refer to the UN Global Compact ten principles, as well as other Environmental, Social and Governance (ESG) criteria selected by the investment manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients who plan to invest over the long term; for example 5 years or more; and are looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT World Screened Equity Index FGR Feeder Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

- KID - Unit Class A EUR

- KID - Unit Class A USD

- KID - Unit Class B EUR

- KID - Unit Class C EUR

- KID - Unit Class D EUR

- KID - Unit Class E EUR

- KID - Unit Class I EUR

- KID - UNIT CLASS J EUR

- KID - Unit Class A EUR (DE)

- KID - Unit Class A USD (DE)

- KID - Unit Class B EUR (DE)

- KID - Unit Class C EUR (DE)

- KID - Unit Class D EUR (DE)

- KID - Unit Class E EUR (DE)

- KID - Unit Class I EUR (DE)

- KID - UNIT CLASS J EUR (DE)

- KID - Unit Class A EUR (SE)

- KID - Unit Class A USD (SE)

- KID - Unit Class B EUR (SE)

- KID - Unit Class C EUR (SE)

- KID - Unit Class D EUR (SE)

- KID - Unit Class E EUR (SE)

- KID - Unit Class I EUR (SE)

- KID - UNIT CLASS J EUR (SE)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

World Custom ESG Minimum Volatility Equity Index

The investment objective of the Fund is to closely match the risk and return of the MSCI World Custom ESG Minimum Volatility (EUR) Index with net dividends reinvested. A custom index calculated and screened by MSCI based on Environmental, Social and Governance (ESG) criteria selected by Northern Trust which excludes certain companies not considered to meet socially responsible principles.

Investor Profile

- Open to all investors

- Suitable for those seeking diversified equity exposure to developed markets across North America, Europe and Asia whilst meeting their environmental, social and governance commitments.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The risk number for World Custom ESG Minimum Volatility Equity Index is 6. Read the Key Investor Information Document. This is a mandatory Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Literature

Download Key Investor Information Documents & prospectus

NT World Small Cap Low Carbon Equity Index FGR Feeder Fund

The investment objective of the Fund is to closely match the risk and return of the MSCI World Small Cap Select Low Carbon Index (the Index) with net dividends reinvested through the master-feeder structure. The Index corresponds with the MSCI World Small Index with the exclusion of companies not considered to meet socially responsible principles identified by applying criteria that refer to the UN Global Compact ten principles, as well as other Environmental, Social and Governance (ESG) criteria selected by the investment manager.

Investor Profile

- Open to all investors

- This Fund is appropriate for clients looking for a passively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions who plan to invest over the long term.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

- KID - Unit Class A EUR

- KID - Unit Class B EUR

- KID - Unit Class C EUR

- KID - Unit Class E EUR

- KID - Unit Class F EUR

- KID - Unit Class H GBP

- KID - Unit Class K EUR

- KID - Unit Class A EUR (DE)

- KID - Unit Class B EUR (DE)

- KID - Unit Class C EUR (DE)

- KID - Unit Class E EUR (DE)

- KID - Unit Class F EUR (DE)

- KID - Unit Class H GBP (DE)

- KID - Unit Class K EUR (DE)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

NT World PAB Plus Equity Select Index FGR Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI World PAB Plus Equity Select Index (the "Index") with net dividends reinvested. The Index is designed to meet the standards of the EU Paris Aligned Benchmark (PAB), aiming to reduce the weighted average greenhouse gas intensity relative to the MSCI World Index (the “Parent Index”) by 50% and reduce the weighted average greenhouse gas (GHG) intensity by 7% on an annualized basis.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

NTCM World Journey Equity Index Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI World Journey Select Index (the “Index”) with net dividends reinvested. The Index is designed to reduce the weighted average greenhouse gas (“GHG”) intensity by 50% by Enterprise Value Including Cash (“EVIC”) relative to the Parent Index and reduce the weighted average GHG intensity by 7% by EVIC on an annualized basis. The Index aims to increase exposure to companies that are considered well prepared for the transition to the low carbon economy, or that demonstrate positive management of environmental and social risk factors. Additionally, the index aims to reduce exposure to companies associated with adverse impact on natural resources according to select indicators.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- May not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

NT Europe Selection P-Series Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return of the MSCI Europe Region ESG Selection P-Series Index (the “Index”) with net dividends reinvested.The Index is a free float-adjusted market capitalization-weighted index designed to represent the performance of companies that are selected from an underlying index based on Environmental, Social and Governance (ESG) criteria across 15 Developed Markets (DM) countries in Europe. The Index is derived from MSCI Europe Index (the “Parent Index”) to limit the systematic risk and country/region-specific risk introduced by the ESG selection process. The Index is constructed by applying the index construction rules at the level of MSCI Europe Index. It aims to target sector weights that reflect the relative sector weights of the MSCI Europe Index. It excludes constituents based on ESG ratings, exposure to ESG controversies or involvement in specific business activities and targets 50% free float-adjusted market capitalization coverage of each Global Industry Classification Standard (GICS®) sector by selecting constituents primarily based on criteria including the ESG rating and the company’s industry-adjusted ESG score.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- This fund may not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

NT USA Selection P-Series Equity Index FGR Fund

The investment objective of the Fund is to closely match the risk and return of the MSCI USA ESG Selection P-Series Index (the “Index”) with net dividends reinvested. The Index is a free float-adjusted market capitalization-weighted index designed to represent the performance of companies that are selected from an underlying index based on ESG criteria across the US market. The Index is derived from the MSCI USA index (the “Parent Index”) and aims to achieve sector weights that reflect the sector weights of the Parent Index. The Index is constructed by excluding constituents based on ESG ratings, exposure to ESG controversies or involvement in specific business activities and target 50% free float-adjusted market capitalization coverage of each Global Industry Classification Standard (GICS®) sector by selecting constituents primarily based on criteria including the ESG rating and the company’s industry-adjusted ESG score.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- This fund may not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

NTCM Emerging Markets Journey Equity Index Fund

The investment objective of the Fund is to closely match the risk and return characteristics of the MSCI Emerging Markets Journey Select Index (the "Index") with net dividends reinvested. The Index is designed to reduce the weighted average greenhouse gas (“GHG”) intensity by 50% by Enterprise Value Including Cash (“EVIC”) relative to the Parent Index and reduce the weighted average GHG intensity by 7% by EVIC on an annualized basis. The Index aims to increase exposure to companies that are considered well prepared for the transition to the low carbon economy, or that demonstrate positive management of environmental and social risk factors. Additionally, the index aims to reduce exposure to companies associated with adverse impact on natural resources according to select indicators.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors who plan to invest over the medium to long term; and are looking for a passively managed investment in the relevant market(s) with Environmental, Social and Governance (ESG) principles implemented according to a defined set of exclusions.

- This fund may not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

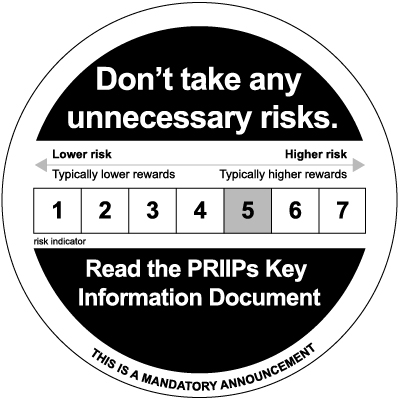

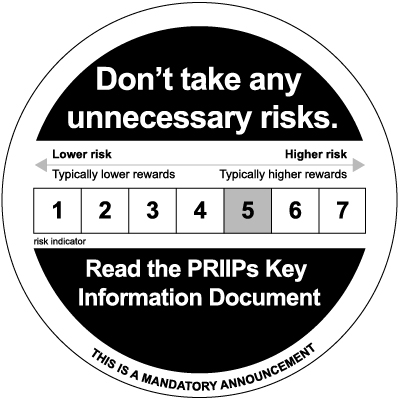

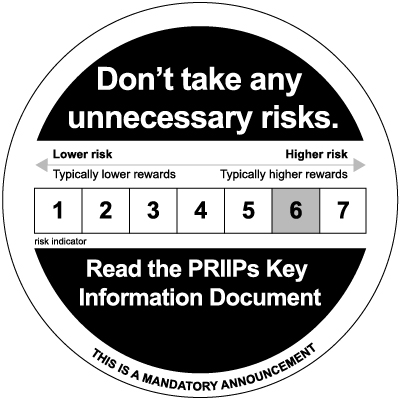

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NTCM Emerging Markets Journey Equity Index Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

Adopting a factor-based approach

Factor-based investing is founded on the concept of improving returns through diversification. Historically, this involved diversifying portfolios by asset classes, but this approach has proven itself unreliable. Factor-based investing offers another means for investors to reduce risk and bolster investment returns by targeting specific risk exposures such as value, low volatility, dividend yield and quality. Different risk factors can be combined to improve a portfolio's ability to target goals such as generating income or reducing volatility.

Choose a Factor Fund:

NT Europe Value Select Equity FGR Feeder Fund

The investment objective of the Fund is to deliver long-term capital growth by investing in equities through the master-feeder structure (that is shares and other similar kinds of assets) issued by or relating to companies included in the MSCI Europe Index which exhibit certain characteristics, namely value, quality and momentum factors excluding securities that do not meet certain environmental, social and governance (ESG) criteria.

Investor Profile

- Open to all investors.

- This Fund is appropriate for clients looking for an actively managed investment in the relevant market(s) who plan to invest over the long term.

- May not be appropriate for investors planning to withdraw money within five years.

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

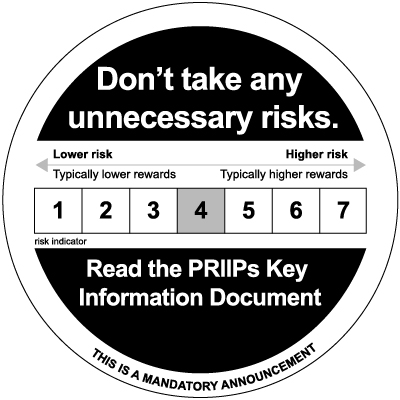

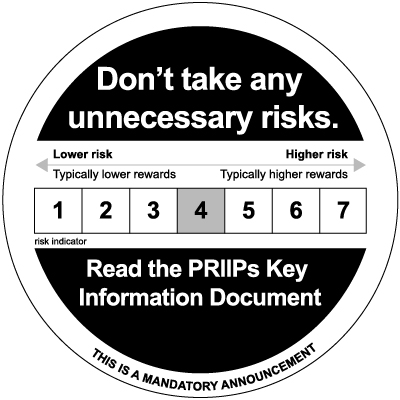

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT Europe Value Select Equity FGR Feeder Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

COUNTRY SUPPLEMENTS

NT World High Dividend Select Equity FGR Feeder Fund

The investment objective of the Fund is to deliver long-term capital growth by investing in a diverse portfolio of high quality dividend paying companies, through the master-feeder structure, whilst controlling for market risk and aiming for an improvement in the environment, social and governance ("ESG") characteristics of the portfolio.

Investor Profile

- Open to all investors

- This Fund is appropriate for investors looking for an actively managed investment in the relevant market(s) with ESG principles implemented according to a defined set of exclusions as well as assessment of ESG ratings.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

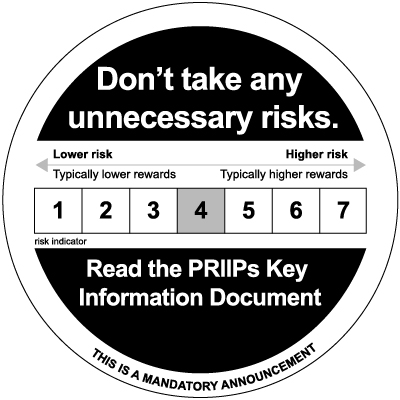

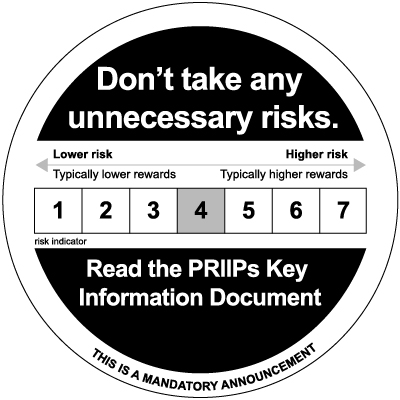

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The

risk number for NT World High Dividend Select Equity FGR Feeder Fund is 6. Read the Key Investor Information Document. This is a mandatory

Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Sustainable Finance Disclosures Regulation (SFDR)

To access the SFDR related disclosure and documents please visit our dedicated page

Literature

PROSPECTUS/WEBSITE DISCLOSURE

FACTSHEETS

KEY INFORMATION DOCUMENTS (PRIIPs KIDs)

KEY INVESTOR INFORMATION DOCUMENTS (UCITS KIIDs)

COUNTRY SUPPLEMENTS

REPORT OF INCOME FOR UK TAX PURPOSES

World Custom ESG Minimum Volatility Equity Index

The investment objective of the Fund is to closely match the risk and return of the MSCI World Custom ESG Minimum Volatility (EUR) Index with net dividends reinvested. A custom index calculated and screened by MSCI based on Environmental, Social and Governance (ESG) criteria selected by Northern Trust which excludes certain companies not considered to meet socially responsible principles.

Investor Profile

- Open to all investors

- Suitable for those seeking diversified equity exposure to developed markets across North America, Europe and Asia whilst meeting their environmental, social and governance commitments.

- May not be appropriate for investors planning to withdraw money within five years

Please seek appropriate investment advice to determine the suitability of this fund for your investment needs.

Risk Characteristics

Risk Indicator, the lower the number the lower the risk the higher the number the higher the risk. The risk number for World Custom ESG Minimum Volatility Equity Index is 6. Read the Key Investor Information Document. This is a mandatory Announcement. The name of the fund and the risk level will change for each pdf.

Don’t take any unnecessary risks.

Read the PRIIPs Key Information Document.

Investment in the Fund involves a degree of risk. There is no guarantee that the Fund's investment objective, or its risk monitoring, will be achieved and results may vary substantially over time. The Fund's investment strategy may carry considerable risks. The value of investments and the income from them, can go down as well as up and an investor may not get back the amount originally invested.

This is a mandatory announcement.

Literature

Download Key Investor Information Documents & prospectus