FGR at a Glance

The Northern Trust range of FGR funds is designed to make life simple:

-

Dutch-Domiciled

These funds are the first index tracking FGR funds designed specifically for Dutch investors. They are subject to standard Dutch fiscal treatment and may offer advantages over foreign-domiciled funds.

-

Tax-Efficient

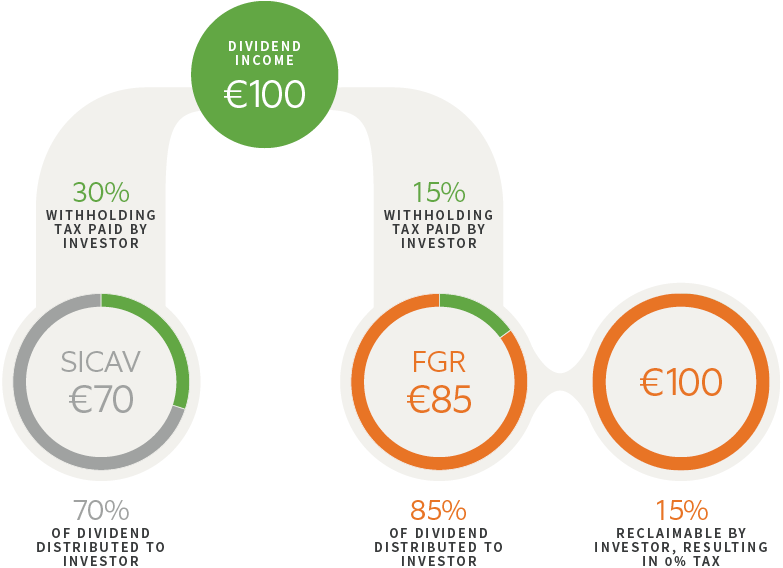

Investors generally have to pay an average of 15 to 30% withholding tax, substantially diluting their potential income. The unique structure of the FGR allows us to recoup part of that tax for our investors, reducing tax liability and potentially increasing income.

-

Cost-Effective

The passive structure of these funds means they are naturally low in cost. They also benefit from our unique, disciplined Intelligent Indexing® investment process. This combines strategic market insights and sophisticated analysis to produce consistent and efficient market exposure.

-

Diverse Range

With 15 funds and over $21bn (as at 31 May 2022) already invested, our range of funds covers key investment strategies and meets core ESG requirements. The funds also give investors the opportunity to incorporate factor-based investing in their portfolios.